How to Start an Emergency Fund

In today’s unpredictable world, having an emergency fund is more important than ever. An emergency fund acts as a financial safety net that can help you navigate unforeseen expenses without falling into debt. Here’s a step-by-step guide to help you start building your emergency fund.

Understand the Importance of an Emergency Fund

An emergency fund is essential for covering unexpected expenses such as medical emergencies, car repairs, or sudden job loss. It provides peace of mind and financial security, ensuring that you don’t have to rely on credit cards or loans during tough times.

Determine Your Savings Goal

Before you start saving, it’s crucial to determine how much you should aim to save. Typically, financial experts recommend having three to six months’ worth of living expenses set aside.

- Calculate your monthly expenses, including rent/mortgage, utilities, food, and other necessities.

- Multiply this amount by the number of months you wish to cover. For example, if your monthly expenses are $2,000, aim to save between $6,000 to $12,000.

Start Small and Build Gradually

Saving a significant amount might feel daunting. However, you can start small and increase your savings over time. Begin by setting a modest initial goal, such as saving $500, and increase your target as you progress.

Set Up a Dedicated Savings Account

It’s advisable to open a different savings account exclusively for your emergency fund. This ensures that the funds are separate from your everyday spending money and minimizes the temptation to dip into your savings.

Automate Your Savings

Automating your savings makes the process effortless and consistent. Set up automatic transfers from your checking account to your emergency fund account after each paycheck. This way, you prioritize saving before spending on discretionary expenses.

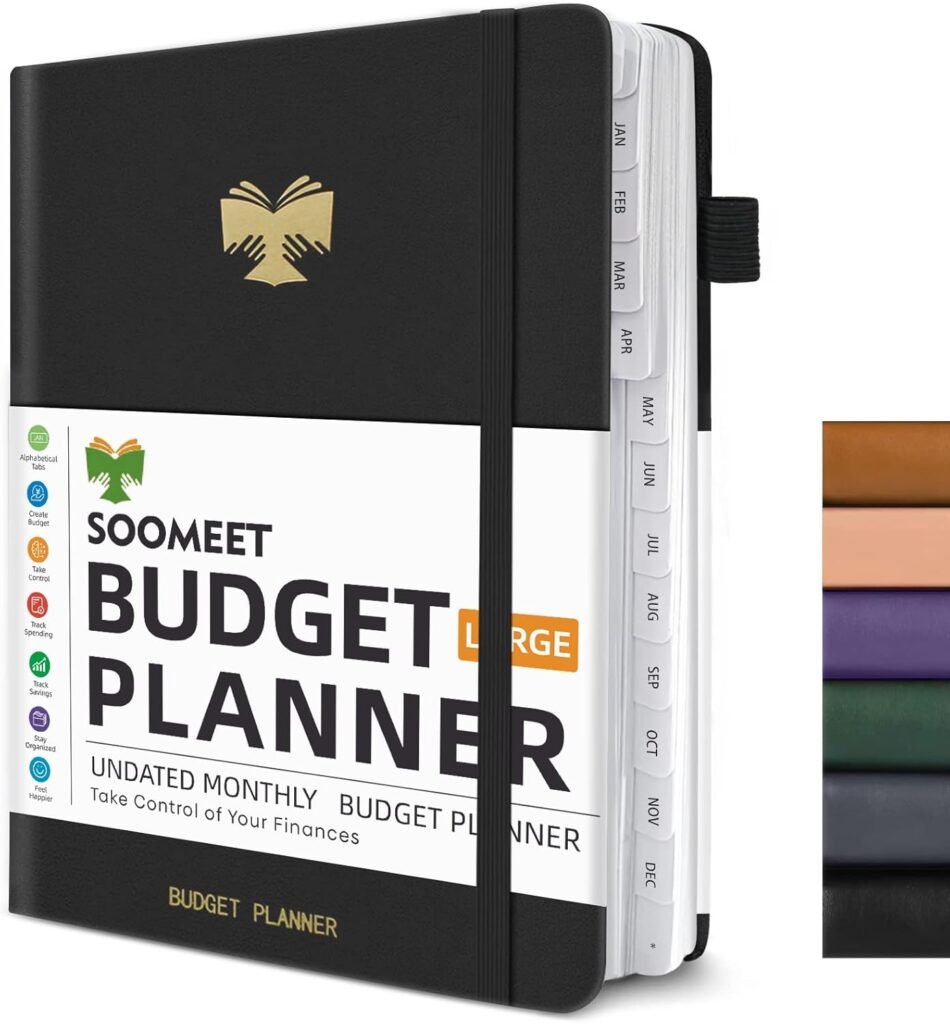

For effective savings strategies, consider using a budgeting planner to track expenses and organize savings goals. Check out the Finance Freedom Budget Planner to learn more and create an effective action plan.

Cut Unnecessary Expenses

Review your monthly expenses to identify areas where you can cut costs and redirect those funds to your emergency fund:

- Cancel subscriptions and memberships you no longer use.

- Cook meals at home instead of dining out frequently.

- Shop around for better rates on insurance or utilities.

Increase Your Income

If you’re finding it challenging to save with your current budget, look for ways to increase your income. This could include taking on a side job, freelancing, or selling unnecessary items.

Review and Adjust Regularly

As your financial situation changes, regularly review your emergency fund, and adjust your contributions if necessary. Life circumstances, such as a new job or changes in expenses, may require a reevaluation of your savings goals.

Starting an emergency fund might seem overwhelming, but by taking small, consistent steps, you can build a robust safety net. Remember, every dollar saved today contributes to a more secure financial future.