Paying off debt can feel like an overwhelming task, but with the right strategies, you can become debt-free faster than you might think. This article provides practical tips to accelerate your journey to financial freedom.

1. Create a Budget

To effectively manage your debt, it’s crucial to have a detailed understanding of your income and expenses. A well-structured budget will help you allocate funds towards debt repayment and track your progress.

- Start by listing all sources of income and all fixed and variable expenses.

- Identify areas where you can cut back to free up more money for debt payments.

2. Prioritize Your Debts

When dealing with multiple debts, it’s important to have a plan of attack. Decide on a payment strategy that works for you, such as the avalanche method or the snowball method.

- With the avalanche method, focus on paying off debts with the highest interest rates first.

- With the snowball method, pay off the smallest debts first to build momentum.

3. Increase Your Payments

Making more than the minimum payment on your debts can significantly reduce the total amount you pay over time and shorten your repayment period.

- Whenever possible, pay more than the minimum required amount.

- Consider making bi-weekly payments instead of monthly payments.

4. Use Windfalls Wisely

Occasional financial windfalls like tax refunds and bonuses can be an excellent opportunity to make a substantial impact on your debt.

- Dedicate a substantial portion, or even all, of these windfalls towards debt repayment.

- Avoid the temptation to splurge; instead, focus on long-term financial benefits.

5. Consider Debt Consolidation

Debt consolidation can help simplify debt repayment by combining multiple debts into a single loan with a potentially lower interest rate.

For more help, consider using the Debt Consolidation Tool to learn more about this option and evaluate whether it’s right for you.

6. Avoid Additional Debt

While paying off existing debt, it’s essential to avoid taking on new debt. Maintain a strict hold on credit card usage and refrain from financing new purchases unless absolutely necessary.

- Use a cash-based system for discretionary spending.

7. Monitor Your Progress

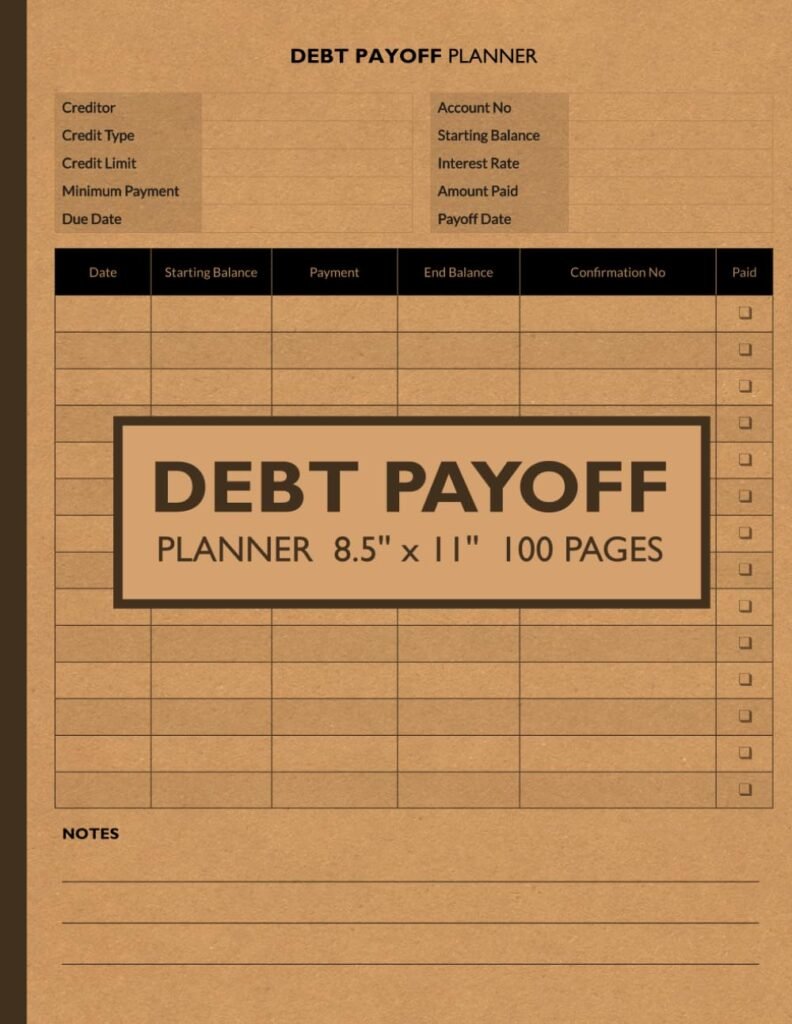

Staying motivated is key to completing your debt payoff journey. Regularly tracking your progress helps maintain focus and motivation.

- Set monthly or quarterly goals to measure your progress.

- Celebrate small victories to keep your morale high.

By employing these strategies, you’ll be on your way to paying off your debt faster. Taking control of your finances is not only empowering but also essential for achieving financial independence. Be persistent, stay motivated, and remember: every little bit helps when it comes to chipping away at your debt.