As we move further into 2025, managing personal finances has never been easier due to the abundance of budgeting apps available today. These apps help users track expenses, create detailed budgets, and even provide insights into spending habits. Here, we delve into some of the top budgeting apps for 2025 that are defining the market.

The Top Budgeting Apps of 2025

- Mint

- Free and easy to use.

- Connects to almost any bank account.

- Automatically categorizes expenditures.

- YNAB (You Need A Budget)

- Emphasizes goal setting and saving.

- Provides educational resources and webinars.

- Subscription-based with a free trial.

- Goodbudget

- Envelope method of budgeting.

- Best suited for couples and families.

- Free version available with premium features.

In the digital age, when budgeting can be streamlined with smart technology, finding the right tool can transform your financial management. Whether you’re just getting started with budgeting or looking to refine your financial strategy, these apps offer user-friendly interfaces and valuable features to help you succeed.

Introducing an Innovative Budgeting Tool

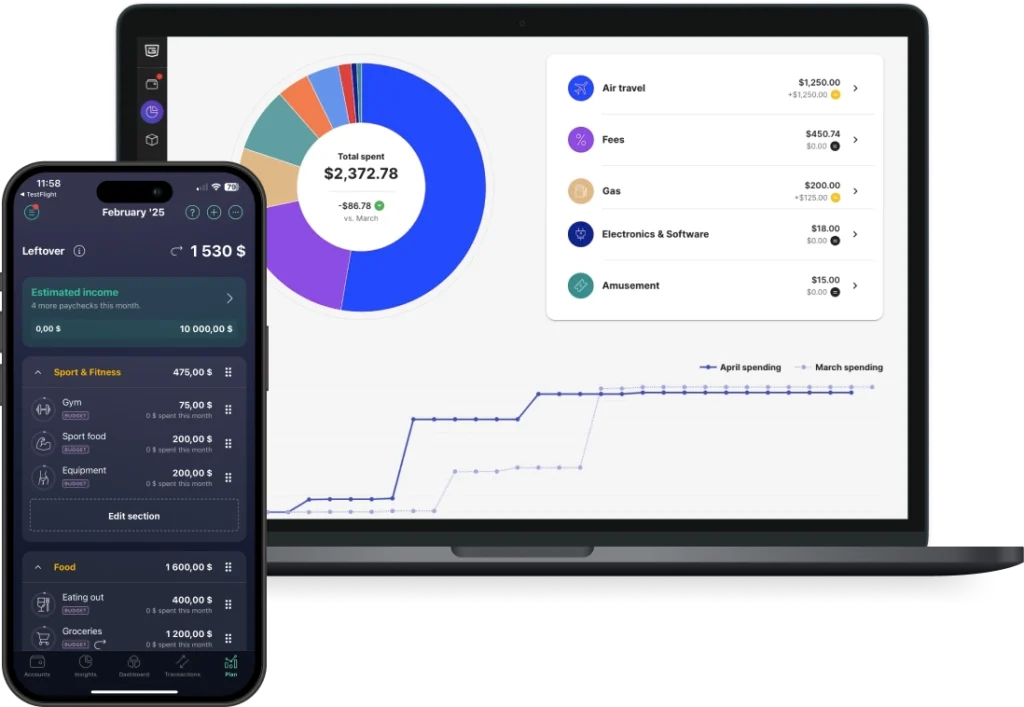

Amidst the myriad of options available, one standout product worth mentioning is PocketGuard. Designed for simplicity and efficiency, PocketGuard connects all your financial accounts and gives you a clear picture of your monthly budget and remaining spendable income. An intuitive app that sets itself apart with innovative features and user-centric design.

For those who are serious about gaining control over their finances, PocketGuard makes it easy to visualize your spending and savings goals. If you’re looking to make expense tracking as seamless as possible, Check out PocketGuard to learn more.

Honorable Mentions

- Personal Capital – Ideal for those who want budgeting combined with insightful investment tracking.

- EveryDollar – Perfect for zero-based budgeters needing simplicity and focus.

- Spendee – Known for its colorful, user-friendly interface and shared wallets.

In conclusion, the right budgeting app depends on your personal financial needs and goals. Whether it’s automated tracking with Mint, goal-oriented planning with YNAB, or adopting a minimalist approach with PocketGuard, there’s an app in 2025 for everyone. By choosing the right digital tool, you’re empowering yourself to make informed financial decisions, paving the way to financial freedom.